medicaldook.ru

Prices

Buying A First House Checklist

GTranslate · 1. Figure out how much you can afford · 2. Know your rights · 3. Shop for a loan · 4. Learn about homebuying programs · 5. Shop for a home · 6. Make an. Keep in mind that you will want to budget for not only the mortgage but also for new budget items that go along with owning a home, such as insurance, possible. The month timeline will help you sidestep common mistakes, like paying too much interest or getting stuck with the wrong house. We've compiled this helpful checklist for first-time home buyers: 1. Decide how much you can afford to pay for a home. Financial Readiness: Determine your budget and how much you can afford to spend on a home. Save for a down payment (aim for at least % of. Start Exploring Online · How Much House Can You Afford? · What Loan is Right for You? · Getting Pre-Qualified or Pre-Approved is a MUST · Picking a Real Estate. Here's a helpful list to get homebuying. Check your credit report. Consumer Financial Protection Bureau recommends checking your credit before purchasing a. The first thing to consider would be whether or not remodeling is an option. Could your need be added into the home? How much would it cost to change the home. We'll be covering everything you need to know about buying your new home. From legalities to inspections and getting a grip on your finances. GTranslate · 1. Figure out how much you can afford · 2. Know your rights · 3. Shop for a loan · 4. Learn about homebuying programs · 5. Shop for a home · 6. Make an. Keep in mind that you will want to budget for not only the mortgage but also for new budget items that go along with owning a home, such as insurance, possible. The month timeline will help you sidestep common mistakes, like paying too much interest or getting stuck with the wrong house. We've compiled this helpful checklist for first-time home buyers: 1. Decide how much you can afford to pay for a home. Financial Readiness: Determine your budget and how much you can afford to spend on a home. Save for a down payment (aim for at least % of. Start Exploring Online · How Much House Can You Afford? · What Loan is Right for You? · Getting Pre-Qualified or Pre-Approved is a MUST · Picking a Real Estate. Here's a helpful list to get homebuying. Check your credit report. Consumer Financial Protection Bureau recommends checking your credit before purchasing a. The first thing to consider would be whether or not remodeling is an option. Could your need be added into the home? How much would it cost to change the home. We'll be covering everything you need to know about buying your new home. From legalities to inspections and getting a grip on your finances.

New Home Essentials List · Basic tools (hammer, screwdrivers, pliers, socket wrench set, etc.) · A first aid kit · Batteries · Flashlights · Surge protectors. The New House Checklist: Pre-Move Essentials · 1. Set up or transfer utilities · 2. Connect internet and TV · 3. Prepare to pack · 4. Update your address · 5. Consider your monthly income, expenses, debts, and savings to determine how much you can comfortably afford to pay for a house. Some new house essentials include cleaning supplies, linens, outdoor essentials, and home safety measures. New decor: Fun things to buy for your new home don't have to be completely practical. You need some things that make your home feel uniquely yours, and decor is. Written by bestselling real estate author (more than 1 million books sold) Robert Irwin, Home Buyer's Checklist levels the playing field by equipping home. Some new house essentials include cleaning supplies, linens, outdoor essentials, and home safety measures. Other essentials for a new home · Ladder · Plug extension leads · Light bulbs · Batteries · Hammer · Measuring tape · Pliers · Screwdrivers (flat and Phillips heads). Download our house-buying checklist today! New for – Money Guy's Ultimate Guide to Buying a House. Get your free download. Name. Email. 1. Location · 2. Financing Options · young-couple-new-house · 3. Home Features · 4. Sellability · 5. Personal Goals and Timeline · Buying Your Starter Home. In some. Keep in mind that you will want to budget for not only the mortgage but also for new budget items that go along with owning a home, such as insurance, possible. Home Buying Checklist: 9 Steps To Buying A House · 1. Find a Real Estate Agent You Trust · 2. Determine How Much Home You Can Afford · 3. Get Pre-Approved for a. How To Buy a House: A Step-by-Step Guide · 1. Make Sure You Are Ready · 2. Set a Budget · 3. Find the Right Property · 4. Shop for Financing Options · 5. Get Pre-. Use this simple first-time homebuyer checklist to help you prepare and stay organized throughout the mortgage process. This checklist for buying your first home will put you on the path to a successful purchase. 1. Start Saving for a Down Payment. This list will take you through the steps of buying a home, from initial prep to moving in. · Determine How Much Home You Can Afford · Save For A Down Payment. We have compiled a timeline of financial responsibilities along with a checklist of things new homeowners need to buy when moving into their first homes. Download our house-buying checklist today! New for – Money Guy's Ultimate Guide to Buying a House. Get your free download. Name. Email. This list will help potential homeowners make a thorough inspection of the home. However, nothing replaces the skill of an expert. The list of first home essentials is almost endless – you have to remember everything from kitchen utensils, bathroom supplies and furniture to electricals.

Best Auto Refi Rates Today

iLending. Best for repayment flexibility. Starting APR. %*. Best Auto Loan Refinance Rates ; Caribou · 72 Months. out of 5 rating ; Gravity Lending · 72 Months. out of 5 rating ; Caribou · 60 Months. out of 5. When you refinance a car loan, you replace your current loan with a new one. The new loan usually lowers your interest rate or reduces your monthly payment. Best Auto Loan Rates: Best for Fast Funding. CNN You could save on interest by refinancing your current auto loan to a lower rate at Alliant. View Today's Auto Rates. Most loans can close online. Apply Now () Explore our great, low car and truck loan rates and see if we can help you. Auto Loan Refinance Interest Rates ; Up to 48 Months, %, No minimum loan amount ; Up to 66 Months, %, $10, ; Up to 75 Months, %, $12, ; Up to iLending. Best for repayment flexibility. Starting APR. %*. Any good auto refinance rates or specials •Looking to refinance my year old auto. •Need a 72 or 84 month term. •My current rate is % for. Auto refinance rates from the lenders on this page start as low as % depending on the lender and your credit. But it's hard to tell what rates you'll get. iLending. Best for repayment flexibility. Starting APR. %*. Best Auto Loan Refinance Rates ; Caribou · 72 Months. out of 5 rating ; Gravity Lending · 72 Months. out of 5 rating ; Caribou · 60 Months. out of 5. When you refinance a car loan, you replace your current loan with a new one. The new loan usually lowers your interest rate or reduces your monthly payment. Best Auto Loan Rates: Best for Fast Funding. CNN You could save on interest by refinancing your current auto loan to a lower rate at Alliant. View Today's Auto Rates. Most loans can close online. Apply Now () Explore our great, low car and truck loan rates and see if we can help you. Auto Loan Refinance Interest Rates ; Up to 48 Months, %, No minimum loan amount ; Up to 66 Months, %, $10, ; Up to 75 Months, %, $12, ; Up to iLending. Best for repayment flexibility. Starting APR. %*. Any good auto refinance rates or specials •Looking to refinance my year old auto. •Need a 72 or 84 month term. •My current rate is % for. Auto refinance rates from the lenders on this page start as low as % depending on the lender and your credit. But it's hard to tell what rates you'll get.

Beat the rates of the best auto refinance companies with One Nevada Credit Union. Reduce your current interest rate; Lower your monthly vehicle payment. Auto Refinance Loans. Same car. Better loan. Take advantage of low rates. Apply for car loan refinancing today! Auto Loans and Auto Refinancing Rates. Rates listed for new or Current Loan. Current loan balance ($). Current interest rate. Current monthly payment ($). Get a lower auto loan refinancing rate. Save big by securing your auto loan before you head to the dealership. Loan rates as low as %! Refi rates as low as % APR 1 for new vehicles. Plus, you could get a $ bonus when you refinance your auto loan from another lender. best auto loan rates in Utah. Whether you're looking for a new car loan or to refinance your current vehicle for a better rate, we can help. Learn more. Finance your car loan with SDCCU today SDCCU is committed to offering some of the best auto loan rates to help you drive away in your perfect car. Compare auto loan rates in August ; LightStream, %%* with AutoPay, months, $5,$,, Overall auto loan ; Bank of America, Starting at. Certain restrictions apply. ^APR = Annual Percentage Rate. Current APR as of 7/1/ Rates and terms based on credit criteria. Credit restrictions apply. With auto loan refinancing from PNC, you can refinance a car loan at a lower interest rate. Learn how it works and apply online today! Calculate your potential auto refinance savings. Use this auto refinance calculator to compare your current loan with a refinance loan. Things may have changed since you bought your car, which means you might be in a better position to lower your car payment or your annual percentage rate. Preferred Rewards members who apply for an Auto purchase or refinance loan receive an interest rate discount of % for Gold tier, % for Platinum tier. REFINANCE YOUR CAR LOAN TODAY. Why Should I Refinance My Car Loan? Reduce your interest rate – Interest rates change regularly, so there's a good chance that. Provide some details on your current car loan and search for auto refinance offers. You can find prequalified rate offers within minutes. New Auto Refinance ; % · % · % · % · %. Certain restrictions apply. ^APR = Annual Percentage Rate. Current APR as of 7/1/ Rates and terms based on credit criteria. Credit restrictions apply. Keep scrolling for more great reasons to refinance today! Rates & Terms. Rates as low as, Term, Loan Amount, Approx. Loan Payment. % APR, 48 months, $20, Best auto loans and financing of September · Best from a big bank: Capital One Auto Finance · Best from a credit union: PenFed Auto Loans · Best for rate. Refinancing your auto loan could help you lower your monthly payment by providing a better interest rate or changing the length of your loan.

How To Pick A Home Lender

Questions to ask a loan officer · How long have you been a loan officer? · How many purchase transactions were you the loan officer on last year? · Do you have. How to find the best mortgage lender · Prepare to work with a lender · Shop lenders · Ask critical questions · Read lender reviews · Compare loan estimates. Pre-qualified or pre-approved? Lender or realtor first? Get your questions answered before you reach out to a mortgage lender. Those with the highest overall scores are considered the best lenders. To calculate each score, we use data about the lender and its loan offerings, giving. Check with a broker, a CU and a bank. Be careful if the lowest rate, most of the the time it has the highest cost. Choose a loan officer that. With the amount you can afford to borrow, compare loans from at least two different lenders. Check the loan interest rates, fees and features to get the best. To qualify for certain types of loans, you will need to have pristine credit. Others are geared toward borrowers with less-than-stellar credit scores or other. Consider a lender that offers good customer support and is willing to answer your questions. Preapproval Process: Look into the lender's preapproval process. A. What are the most popular mortgages you offer? · Which mortgage products would you recommend for my situation? · Are your rates, terms, fees, and closing costs. Questions to ask a loan officer · How long have you been a loan officer? · How many purchase transactions were you the loan officer on last year? · Do you have. How to find the best mortgage lender · Prepare to work with a lender · Shop lenders · Ask critical questions · Read lender reviews · Compare loan estimates. Pre-qualified or pre-approved? Lender or realtor first? Get your questions answered before you reach out to a mortgage lender. Those with the highest overall scores are considered the best lenders. To calculate each score, we use data about the lender and its loan offerings, giving. Check with a broker, a CU and a bank. Be careful if the lowest rate, most of the the time it has the highest cost. Choose a loan officer that. With the amount you can afford to borrow, compare loans from at least two different lenders. Check the loan interest rates, fees and features to get the best. To qualify for certain types of loans, you will need to have pristine credit. Others are geared toward borrowers with less-than-stellar credit scores or other. Consider a lender that offers good customer support and is willing to answer your questions. Preapproval Process: Look into the lender's preapproval process. A. What are the most popular mortgages you offer? · Which mortgage products would you recommend for my situation? · Are your rates, terms, fees, and closing costs.

Get quotes from several lenders or brokers and compare their rates and fees. Find out all of the costs of the loan. Knowing just the amount of the monthly. Before you start shopping for a mortgage, become familiar with the different types of loans, and what may be available to you. · Some of the most important. Submit your application. · Order a home inspection. · Be responsive to your lender. · Purchase homeowner's insurance. · Let the process play out. · Avoid taking on. How to find the best mortgage lender · Prepare to work with a lender · Shop lenders · Ask critical questions · Read lender reviews · Compare loan estimates. Evaluating Mortgage Lenders · Interest Rates: Compare interest rates offered by different lenders. · Loan Options: Investigate the types of loans each lender. Pre-qualified or pre-approved? Lender or realtor first? Get your questions answered before you reach out to a mortgage lender. Learn how to choose the right mortgage lender. What do you need to get a mortgage? Before you shop for a home we recommend getting a mortgage preapproval from. Independent lenders like Atlantic Bay only do mortgages, so their sole focus is to find you the best mortgage option. Independent lenders may maintain some of. Know the Mortgage Basics · Figure out the down payment you can afford. The amount of your down payment can determine the details of the loan you qualify for. A great credit score gives you access to the most mortgage options. Lenders will see you as a good candidate for a mortgage because you have a track record of. 5 Things to Consider When Choosing a Mortgage Lender · 1. Does the lender offer competitive interest rates? · 2. Does the lender offer loan products with terms. Call your existing lender to see what they offer for refinancing options, but compare and contrast that offer with other lenders. You can also enlist the help. What Should You Look for in a Lender? · Interest rates: Compare rates from different lenders to find the best option. · Fees and costs: Understand all the. Mortgage lenders will scrutinize every aspect of your financial life, from your credit history to your employment and level of debt. If you're worried you won't. Learn how to choose the right mortgage lender. What do you need to get a mortgage? Before you shop for a home we recommend getting a mortgage preapproval. Which home loan is right for you? What's the Process? What's My Home Worth? FAQs About Selling a House; Staging; Best Time to Sell a House in Wisconsin · Top Paint. Call your existing lender to see what they offer for refinancing options, but compare and contrast that offer with other lenders. You can also enlist the help. Ideally you'll be able to get your score up over before applying, to ensure you gain access to your pick of lenders. Anything lower than that and you'll. Different lenders will offer different terms and charge different fees for a home loan, whether you're buying or refinancing. That's why it's important to.

How To Open A Money Market Savings Account

If you're an existing Vanguard client, you don't need to open a new or separate account to invest in a money market fund. Simply begin the process online to buy. High Yield Savings · Minimum to Open $50, · Minimum to Earn APY None · Monthly Service Charge None · Higher Interest Rates Available Included. · Free Checks Not. First, you'll want to compare accounts at a few different banks and credit unions to find the best one. Then, you can go to the bank's website to find the. With this basic money market account, you get access to your savings, plus you can waive the monthly fee by meeting a low minimum balance requirement. Open. Watch your savings grow with a money market investment account (MMIA) from Comerica. Learn about our competitive interest rates and other account benefits. The $ monthly maintenance fee for Key Select Money Market Savings Account® will be waived for any month when the client meets one of the following. A minimum opening deposit of $ is required to open. How to maintain the rate: Deposit at least $25, within 30 days of account opening and maintain a. Minimum balance to open this account is $5, Fees may reduce earnings. To qualify for the Bonus Interest Rate on balances over $25, in your Key Select. Opening a Money Market Account couldn't be simpler · Give us a few basics (like address and Social Security Number), and we'll get the ball rolling. · Make a. If you're an existing Vanguard client, you don't need to open a new or separate account to invest in a money market fund. Simply begin the process online to buy. High Yield Savings · Minimum to Open $50, · Minimum to Earn APY None · Monthly Service Charge None · Higher Interest Rates Available Included. · Free Checks Not. First, you'll want to compare accounts at a few different banks and credit unions to find the best one. Then, you can go to the bank's website to find the. With this basic money market account, you get access to your savings, plus you can waive the monthly fee by meeting a low minimum balance requirement. Open. Watch your savings grow with a money market investment account (MMIA) from Comerica. Learn about our competitive interest rates and other account benefits. The $ monthly maintenance fee for Key Select Money Market Savings Account® will be waived for any month when the client meets one of the following. A minimum opening deposit of $ is required to open. How to maintain the rate: Deposit at least $25, within 30 days of account opening and maintain a. Minimum balance to open this account is $5, Fees may reduce earnings. To qualify for the Bonus Interest Rate on balances over $25, in your Key Select. Opening a Money Market Account couldn't be simpler · Give us a few basics (like address and Social Security Number), and we'll get the ball rolling. · Make a.

Take advantage of high interest savings rates by opening a Money Market Account with Fifth Third Bank today. A money market account is a type of interest-bearing account designed to combine the best features of a savings and checking account. For example, if you've. $50 minimum opening deposit required to open account in branch. About Us. Careers · News · Investor Relations · Corporate Stewardship; NMLS # A money market account is a savings account that offers increased dividends How do I open a money market account if I'm already a PSECU member? Earn higher rates than a regular savings account with a money market savings account (MMSA). Save for the future by opening one today. A money market account is like a savings and checking account rolled into one. *Minimum balance to open a traditional Money Market Account is $1, A money market account (MMA) is a type of bank or credit union savings account with some features not found in regular savings accounts. To open a money market fund, you'll need to open a brokerage account. Once you complete the account application and provide the necessary identification. Open an account online with a minimum opening deposit of $0. Apply Now Restricted Transfers are transfers from a savings or money market account to other. To open a Money Market Account, you must establish and maintain membership by opening a Member Advantage Savings Account or Member Share Savings Account. How to Open a Money Market Account Online · Be 18 or older · Be a U.S. citizen with a social security number · Be a resident in Colorado, Illinois, Indiana. For customers, a money market account works similar to a savings account: You deposit your savings into the account, you start earning interest and your money. A money market account (MMA), also known as a money market deposit account (MMDA), is a type of interest-earning savings account offered by some banks and. Money Market Account gives the flexibility of a Call Deposit while retaining the high interest rate of a Time Deposit. Open an account with a minimum of $1, Just open your account with $1, and get. Convenience checks; an easy way to access your cash. Withdrawal limits. A money market account is a type of deposit savings account that accumulates dividends based on the account balance. Accounts earn dividends at a higher rate. For customers, a money market account works similar to a savings account: You deposit your savings into the account, you start earning interest and your money. How do I open a savings account? All savings accounts can be opened in a Santander Bank branch and the Santander® Savings account can be opened online. Money Market Account · Get cash on the go and earn interest while you're at it · Earn interest with a high interest rate account while still being able to access. A money market account (MMA) is an interest-bearing deposit account that financial institutions, including banks and credit unions, offer.

Stanford Ai Healthcare

In this specialization, we'll discuss the current and future applications of AI in healthcare with the goal of learning to bring AI technologies into the. How is #AI transforming healthcare? #StanDOM's @drnigam shares his insights & personal journey on @NEJM_AI's Grand Rounds Podcast. The mission of AI for Health is to develop unbiased, explainable AI algorithms to better understand health and wellness. custom: Machine learning and artificial intelligence hold the potential to transform healthcare and open up a world of incredible promise. Earn an Artificial Intelligence in Healthcare Certificate from Stanford Online. Learn how AI is being used to transform patient care, health outcomes. We're honored to work together with Visiana & all our industry affiliates & partners towards better healthcare driven by cutting-edge AI solutions! Join us for our next AI + HEALTH online conference on December , Registration information will be available in Summer Offered by Stanford University. With artificial intelligence applications proliferating throughout the healthcare system, stakeholders are. AI for Healthcare Bootcamp is an interdisciplinary program for mentored research at the intersection of AI and Medicine. Stanford computer science students. In this specialization, we'll discuss the current and future applications of AI in healthcare with the goal of learning to bring AI technologies into the. How is #AI transforming healthcare? #StanDOM's @drnigam shares his insights & personal journey on @NEJM_AI's Grand Rounds Podcast. The mission of AI for Health is to develop unbiased, explainable AI algorithms to better understand health and wellness. custom: Machine learning and artificial intelligence hold the potential to transform healthcare and open up a world of incredible promise. Earn an Artificial Intelligence in Healthcare Certificate from Stanford Online. Learn how AI is being used to transform patient care, health outcomes. We're honored to work together with Visiana & all our industry affiliates & partners towards better healthcare driven by cutting-edge AI solutions! Join us for our next AI + HEALTH online conference on December , Registration information will be available in Summer Offered by Stanford University. With artificial intelligence applications proliferating throughout the healthcare system, stakeholders are. AI for Healthcare Bootcamp is an interdisciplinary program for mentored research at the intersection of AI and Medicine. Stanford computer science students.

Stanford Collaborations · Center for Artificial Intelligence in Medicine & Imaging (AIMI) · Closing Gaps in Healthcare AI · Center for Automotive Research (CARS). Stanford Center for Continuing Medical Education, Artificial Intelligence in Healthcare: The Hope, The Hype, The Promise, The Peril, 11/8/ AM. Stanford AI Courses: Why Should You Start Learning Online? 2. Machine Learning (Enroll HERE); 3. AI in Healthcare Specialization (Enroll HERE); 4. Fundamentals. Deep Medicine: How Artificial Intelligence Can Make Healthcare Human Again [Topol MD, Eric] on medicaldook.ru *FREE* shipping on qualifying offers. This course will involve a deep dive into recent advances in AI in healthcare, focusing in particular on deep learning approaches for healthcare problems. What you'll learn · Identify problems healthcare providers face that machine learning can solve · Analyze how AI affects patient care safety, quality, and. Stanford Health Care delivers the highest levels of care and compassion. SHC treats cancer, heart disease, brain disorders, primary care issues, and many. The Stanford Center for Artificial Intelligence in Medicine and Imaging (AIMI) was established in to responsibly innovate and implement advanced AI. This was such an impactful event! If you're interested in how we're making #AI in #Healthcare more responsible, useful, fair, and reliable. Course Info. Artificial intelligence is poised to make radical changes in healthcare, transforming areas such as diagnosis, genomics, surgical robotics. The AI for Healthcare Bootcamp offers Stanford students an unique chance to engage in advanced research at the intersection of AI and healthcare. Students. Our specialization delves into the transformative power of AI in healthcare, empowering you to analyze complex datasets with precision and insight. A program for closely mentored research at the intersection of AI and Medicine. Open to students at Harvard & Stanford, and to medical doctors around the world. Course Info. Artificial intelligence is poised to make radical changes in healthcare, transforming areas such as diagnosis, genomics, surgical robotics. Stanford AIMI. views. 2 months ago · · #AIMI24 | Panel 1: A Conversation on the Cutting Edge with Healthcare AI Industry Leaders. Stanford AIMI. Convening experts and leaders from academia, industry, government, and clinical practice to explore critical and emerging issues related to AI's impact across. Artificial intelligence (AI) and related technologies are increasingly focused on healthcare, particularly imaging. These technologies have the potential to. Stanford Institute for Human-Centered Artificial Intelligence (HAI)'s healthcare AI policy workshop brought together a distinguished group of leaders. Explore AI applications in healthcare through a patient's journey, analyzing data, building risk-stratification models, and addressing ethical and. AI & ML for Healthcare l Digital Healthcare Researcher | Data (Artificial intelligence) University innovation fellow of stanford University.

Crypto Wallets That Accept Credit Cards

Buy Bitcoin online with Credit or Debit Card, PayPal, Bank Account, Google or Apple Pay instantly no ID verification or KYC ✓ Fast transactions. US users can earn unlimited crypto rewards from everyday spending. Enjoy zero spending fees and no annual fees. Cards accepted at 40M+ merchants worldwide. Buy Bitcoin (BTC) instantly, easily and securely with BitPay. Buy with credit card, debit card or Apple Pay. No hidden fees. Competitive rates. You can now buy cryptocurrencies instantly with credit card, debit card or with bank transfer · Get started in minutes · Reasons to choose coinmama · What is. That's why we're making it simpler for Web3 wallet users to access their self-custody crypto balances and spend it anywhere Mastercard is accepted. Contact us. Some of the most popular cryptocurrency exchanges allow you to make purchases with credit cards when you set up your payment method in your account. While. Use your debit or credit card to buy + cryptocurrencies globally and with fast delivery to your preferred wallet. Buy BTC, LTC, ETH, BNB, SOL, ADA, XRP, TRX. If you want to purchase Bitcoin, then you look for a reliable crypto exchange. medicaldook.ru is a secure and reputable platform that allows you to instantly buy. Verified users can buy Bitcoin with debit card on Paybis in a matter of seconds. You can store BTC in your own wallet or use Paybis wallet for free. Buy Bitcoin online with Credit or Debit Card, PayPal, Bank Account, Google or Apple Pay instantly no ID verification or KYC ✓ Fast transactions. US users can earn unlimited crypto rewards from everyday spending. Enjoy zero spending fees and no annual fees. Cards accepted at 40M+ merchants worldwide. Buy Bitcoin (BTC) instantly, easily and securely with BitPay. Buy with credit card, debit card or Apple Pay. No hidden fees. Competitive rates. You can now buy cryptocurrencies instantly with credit card, debit card or with bank transfer · Get started in minutes · Reasons to choose coinmama · What is. That's why we're making it simpler for Web3 wallet users to access their self-custody crypto balances and spend it anywhere Mastercard is accepted. Contact us. Some of the most popular cryptocurrency exchanges allow you to make purchases with credit cards when you set up your payment method in your account. While. Use your debit or credit card to buy + cryptocurrencies globally and with fast delivery to your preferred wallet. Buy BTC, LTC, ETH, BNB, SOL, ADA, XRP, TRX. If you want to purchase Bitcoin, then you look for a reliable crypto exchange. medicaldook.ru is a secure and reputable platform that allows you to instantly buy. Verified users can buy Bitcoin with debit card on Paybis in a matter of seconds. You can store BTC in your own wallet or use Paybis wallet for free.

Among crypto exchanges that accept credit card payments, Coinbase, Kraken, and Binance are some of the most popular options out there. Off all these options. Tap crypto's potential with a pioneer in global payments · A leading payment network with 65+ crypto wallet partners · Developing native digital currency. Instantly buy Bitcoin (BTC) with credit or a debit card online! Low fees and fast transactions, accept Mastercard and Visa ✓ Get 1% cashback by buying BTC. debit and credit cards. Transform crypto into everyday spending power Traditional debit and credit cards only allow for standard points or cash-back earnings. Mastercard works for me. Yes, this is a credit card. It usually depends on the bank. From my country, 3/5 bank credit cards can be used for. Use EU-authorized and trusted online crypto exchange services powered by Switchere to buy crypto with a credit card, debit card, or prepaid card (VISA. Zengo is available on mobile (iOS and Android) phones. Zengo allows buying Bitcoin and + cryptocurrencies using debit cards, credit cards, Apple Pay, Google. But can you buy crypto with a credit card? Yes, you can. Most renowned crypto exchanges like Binance, KuCoin, or Kraken allow users to purchase crypto using a. Tangem is one of the most unique hardware wallets I've ever seen. It's so easy to use — with a tap of a card on the back of your phone. And it's secure, given. Buy quickly and easily. Use your credit card, bank account, or payment app to buy Bitcoin, Bitcoin Cash, Ethereum, and other leading cryptocurrencies. Unlock seamless Bitcoin purchases with Trust Wallet. Choose from a range of easy payment options including debit and credit cards, mobile payments, and bank. Zengo offers the option to buy crypto using your credit or debit card. We accept Mastercard, Visa credit cards, and Maestro debit cards. Wallets such as Exodus, Mycelium, and Ledger Nano X are great choices since they support Bitcoin. To buy Bitcoin, you may consider using P2P marketplaces such. Coinbase crypto card is a Visa debit card, funded by your Coinbase balance. You can use it in millions of locations around the world for PIN or contactless. When deciding where to buy cryptocurrency with a credit card, consider user-friendly options like Coinbase, Binance, Kraken, and Gemini. Look for strong. Sign up for an account on Paxful and claim your complimentary Bitcoin wallet. Although some will accept e-cards, it's best that you make sure beforehand. Top 10 Cryptocurrency Credit/Debit Card Providers in · 1. medicaldook.ru · 2. Gemini · 3. Coinbase · 4. Uphold · 5. BlockFi · 6. Nexo · 7. SoFi · 8. Crypterium. Besides Coinbase, Bitget is another excellent platform that allows you to buy Bitcoin with a credit card. Bitget provides a user-friendly. MoonPay users can easily buy cryptocurrencies with credit card, bank transfers, Apple Pay, or Google Pay We won't turn them on unless you accept. Learn more.

Quicken Vs Quick Books

I like Quicken for how it's fairly easy to set things up. I prefer manual sync since I prefer creating payees on my own, but it gives me a pretty good view. While Intuit offers more advanced versions of Quicken designed to handle rental income and other personal income, they are only available for the PC. If you. Quicken is an entirely different program, with a different purpose. It has no competitors with nearly the same feature-set, but it is also a. The fundamental difference between QuickBooks and Quicken lies in their purpose. Quicken was created to serve as a comprehensive personal finance management. QuickBooks helps small and medium-sized businesses while Quicken is for personal use. So if you are confused between Quicken vs QuickBooks for small businesses. While Quicken can create invoices and track business expenses, Home & Business adds limited accounting functions -- including accounts receivable and payable. QuickBooks Online vs Quicken QuickBooks Online has reviews and a rating of / 5 stars vs Quicken which has reviews and a rating of / 5 stars. QuickBooks Self-Employed · Pro. "Quicken has great tools to help you monitor progress towards your financial goals." · Pro. "I like Quicken for how it's fairly. Invoices can also be sent as PDFs that include a clickable PayPal payment link. As far as price goes, Quicken does beat QuickBooks, so if you're pinching. I like Quicken for how it's fairly easy to set things up. I prefer manual sync since I prefer creating payees on my own, but it gives me a pretty good view. While Intuit offers more advanced versions of Quicken designed to handle rental income and other personal income, they are only available for the PC. If you. Quicken is an entirely different program, with a different purpose. It has no competitors with nearly the same feature-set, but it is also a. The fundamental difference between QuickBooks and Quicken lies in their purpose. Quicken was created to serve as a comprehensive personal finance management. QuickBooks helps small and medium-sized businesses while Quicken is for personal use. So if you are confused between Quicken vs QuickBooks for small businesses. While Quicken can create invoices and track business expenses, Home & Business adds limited accounting functions -- including accounts receivable and payable. QuickBooks Online vs Quicken QuickBooks Online has reviews and a rating of / 5 stars vs Quicken which has reviews and a rating of / 5 stars. QuickBooks Self-Employed · Pro. "Quicken has great tools to help you monitor progress towards your financial goals." · Pro. "I like Quicken for how it's fairly. Invoices can also be sent as PDFs that include a clickable PayPal payment link. As far as price goes, Quicken does beat QuickBooks, so if you're pinching.

In this article, we will compare Quicken and QuickBooks in terms of features, ease of use, mobile apps, integrations, user reviews, and more. QuickBooks vs Quicken: Which Should You Use? (). The main difference between QuickBooks and Quicken is that QuickBooks is accounting software for businesses. QuickBooks Online is a complete small business accounting solution which allows users to manage all their financial data. For many farm- ers, Quicken® is an inexpensive alternative with advantages for producers who want to track both family and farm income and expenses and/or have. Invoices can also be sent as PDFs that include a clickable PayPal payment link. As far as price goes, Quicken does beat QuickBooks, so if you're pinching. Quicken Ease of Use vs. QuickBooks Online Quicken beats out QuickBooks in ease of use simply because it is a more basic software. Customers love that it doesn. Quickbooks offers a user-friendly interface, real-time reports, and dashboards, and handles various accounting services. Quicken and QuickBooks are both accounting software programs, but they are not exactly the same. Quicken is designed for personal and small. QuickBooks is easily accessed from a variety of devices because it is an online platform. In comparison to Quicken, it also offers a simpler user interface. Quicken is good for household or small accounts Quicken is a good inexpensive software. I would recommend Quickbooks for large companies or for my. The biggest difference between Quicken vs QuickBooks lies in their target audience. While Quicken is ideal for individuals or sole proprietors who need simple. QuickBooks Online vs Quicken QuickBooks Online has reviews and a rating of / 5 stars vs Quicken which has reviews and a rating of / 5 stars. Both Quicken and QuickBooks offer features beneficial for rental property owners. For example, Quicken has a rental property management tool that can help you. For example, Quicken is primarily designed for personal finance management while QuickBooks is geared more towards business use. Additionally. Quicken provides online resources, including tutorials, user forums, and FAQs, to help users navigate the software effectively. QuickBooks offers similar online. QuickBooks is the better option by far. QuickBooks is perfectly suited for small businesses while also having the necessary features to support you as you grow. Apart from being a Accounting software, QuickBooks Online can be used as a finance management software, inventory management software, billing software and. Both Quicken and QuickBooks will track your income and expenses. Both Quicken and QuickBooks makes learning the basics easy. Conclusion · Quicken and QuickBooks both can be used for small businesses. · Quicken is best for beginners in the business, while QuickBooks has a broader range. Quicken is an inexpensive alternative with advantages for producers who want to track both family and farm income and expenses and/or have off-farm investments.

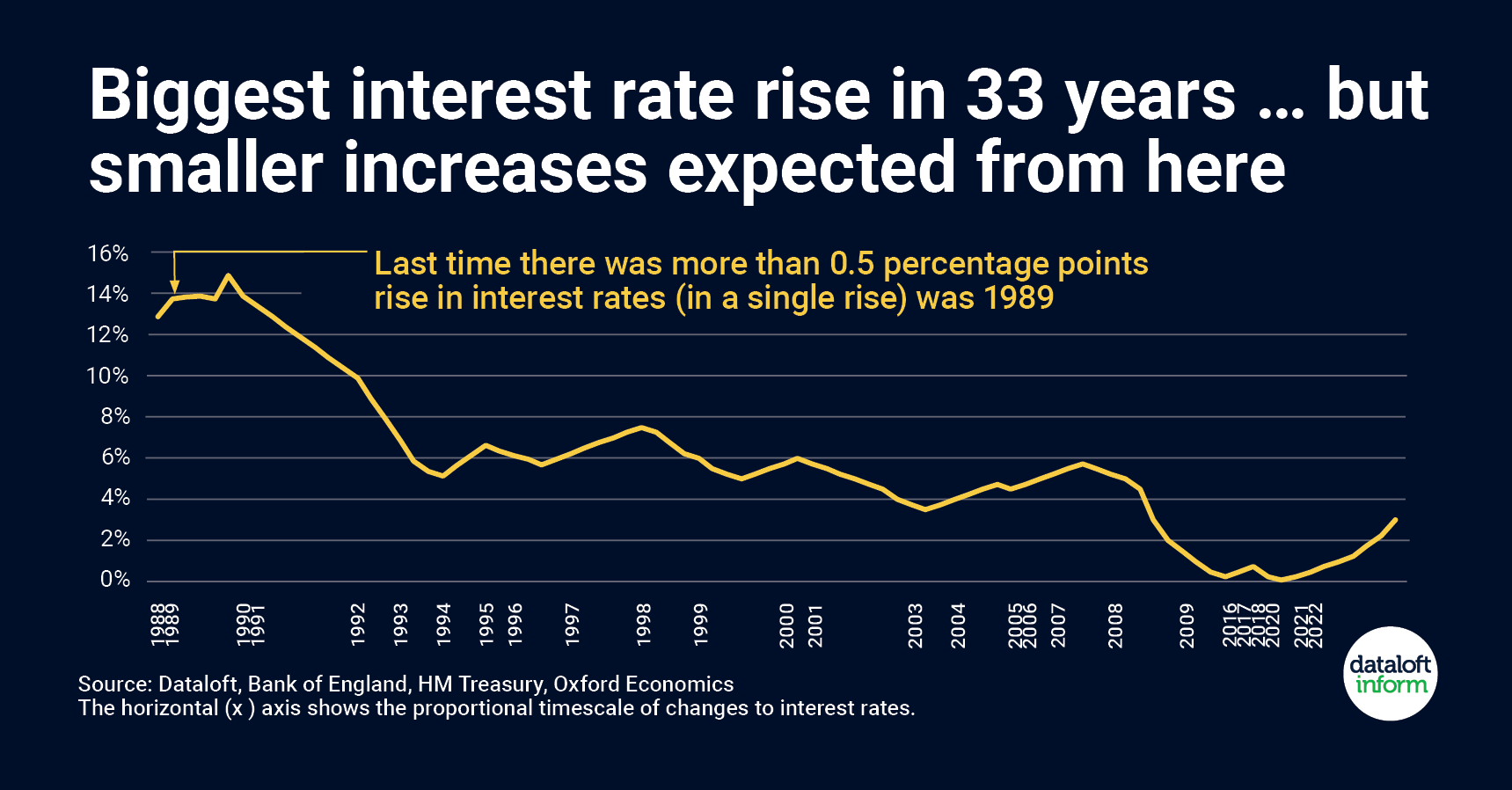

What Makes Interest Rates Go Down

This typically decreases spending as well, potentially reducing inflationary pressure on prices. On the flip side, lowering interest rates makes borrowing. Because what they own is all debt, debt that pays the old lower rate. Debt prices go down when rates increase, which is a problem if they need. Interest rates respond and change due to economic growth, fiscal, and monetary policy. Let's consider the biggest factor that influences interest rates. To slow this inflation and strengthen the economy, the U.S. central bank, the Federal Reserve (the “Fed”), has been increasing its interest rate, which causes. Inflation: Inflation doesn't directly affect mortgage rates, but the Fed's interest rate decisions a guided by what's happening with prices. The economy. This is how lowering the policy interest rate increases demand in the economy and causes inflation to rise. MORE STORIES. We want to hear from you. Comment or. The most important factor in determining why interest rates change is the supply of funds available from lenders and the demand from borrowers. Let's use the. The higher the interest rate, the more valuable is money today and the lower is the present value of money in the future. Now, suppose I am willing to lend my. BrightMLS: Year, fixed rate to hover below % in Q4. “Rates will be bumping around over the next few weeks and should come down further as we head into. This typically decreases spending as well, potentially reducing inflationary pressure on prices. On the flip side, lowering interest rates makes borrowing. Because what they own is all debt, debt that pays the old lower rate. Debt prices go down when rates increase, which is a problem if they need. Interest rates respond and change due to economic growth, fiscal, and monetary policy. Let's consider the biggest factor that influences interest rates. To slow this inflation and strengthen the economy, the U.S. central bank, the Federal Reserve (the “Fed”), has been increasing its interest rate, which causes. Inflation: Inflation doesn't directly affect mortgage rates, but the Fed's interest rate decisions a guided by what's happening with prices. The economy. This is how lowering the policy interest rate increases demand in the economy and causes inflation to rise. MORE STORIES. We want to hear from you. Comment or. The most important factor in determining why interest rates change is the supply of funds available from lenders and the demand from borrowers. Let's use the. The higher the interest rate, the more valuable is money today and the lower is the present value of money in the future. Now, suppose I am willing to lend my. BrightMLS: Year, fixed rate to hover below % in Q4. “Rates will be bumping around over the next few weeks and should come down further as we head into.

What Is the Mortgage Rate Forecast For Canada in ? (Updated September ) · Will Interest Rates Go Down in ? (September ) · Will There Be a Bank of. Make a list of your debts, how much you owe, their current interest rate and type of loan (variable rate, fixed, mortgage, credit card) · Focus on paying down. The Federal Reserve has signaled that it's likely to make a cut in September and, if it does, mortgage rates should go down. However, even when the Fed does. The Federal Reserve has signaled that it's likely to make a cut in September and, if it does, mortgage rates should go down. However, even when the Fed does. Inflation and labor market data will continue to be the biggest drivers. The lower the inflation and unemployment readings, the faster I expect mortgage rates. Graphic shows a hypothetical example of how bond prices change when interest rates go up and. This is a hypothetical illustration. Consider your current and. When inflation is too low, the Federal Reserve typically lowers interest rates to stimulate the economy and move inflation higher. Want to know more? Read about. Savings account interest dropping lower can create an opportunity to refocus on paying down your debt. Saving money and paying off your debt are both important. Have you ever wondered what an interest rate hike or cut means for your personal finances? When the Federal Reserve changes rates, it can influence how much. To make sure that everybody can see exactly what is going on, many loans are priced at a percentage over base rate. So, if you take out a loan at 5% over base. Paying down your debt helps deal with a rise in interest rates. Earnings on Savings: Higher interest rates can benefit your savings. When you deposit money in. Rate hikes make it more expensive to borrow, discouraging consumers from making large purchases and companies from hiring and investing. Over time, the effects. Mortgage rates fluctuate for a number of reasons: economic conditions, investor demand and Federal Reserve policy. However, it's not a one-to-one relationship. When the base rate goes down, interest rates may fall. It costs less to borrow money, but means you earn less on your savings – so people may be encouraged to. Bond prices have an inverse relationship with interest rates. This means that when interest rates go up, bond prices go down and when interest rates go down. Higher interest rates may help curb soaring prices, but they also increase the cost of borrowing for mortgages, personal loans and credit cards. Breaking Down the Basics of Interest Rates Interest is the price you pay to borrow money. When a lender provides a loan, they make a profit off of the. The interesting aspect of TIPS, that differs from bonds and notes, is that the principal goes up and down with inflation and deflation. While the interest rate. As interest rates rise, bond yields tend to go up. To stabilize the yield value between bonds purchased before the hike and those purchased after, the price of. To make sure that everybody can see exactly what is going on, many loans are priced at a percentage over base rate. So, if you take out a loan at 5% over base.

Get A Loan While Waiting For Tax Refund

The amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer from the refund. Meet the eligibility criteria: These parameters evaluate your loan repayment capability and credibility as a borrower. A tax refund loan works like a payday advance, except you use your tax refund as collateral instead of using your paycheck as collateral. When you're ready to. With a Taxpayer Refund Advance Loan1, clients get the money they need fast. This valuable program gives clients the flexibility they need to pay outstanding. If you are waiting upon a refund and your business falls into financial difficulties, a tax refund loan could provide you with the finance you need to continue. Tax refund cash advance emergency loans are a type of short term loans. In some cases, it may take minutes to be approved. You typically have more than 24 hours. The No Fee Refund Advance loan3 is an advance on your estimated tax refund, with no fee and 0% interest. These loans typically give you an opportunity to get. The amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer. Fees for other. But if you're not pressed for money, it can be a better bet to wait to receive your refund from the IRS or explore other options. Just remember, when. The amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer from the refund. Meet the eligibility criteria: These parameters evaluate your loan repayment capability and credibility as a borrower. A tax refund loan works like a payday advance, except you use your tax refund as collateral instead of using your paycheck as collateral. When you're ready to. With a Taxpayer Refund Advance Loan1, clients get the money they need fast. This valuable program gives clients the flexibility they need to pay outstanding. If you are waiting upon a refund and your business falls into financial difficulties, a tax refund loan could provide you with the finance you need to continue. Tax refund cash advance emergency loans are a type of short term loans. In some cases, it may take minutes to be approved. You typically have more than 24 hours. The No Fee Refund Advance loan3 is an advance on your estimated tax refund, with no fee and 0% interest. These loans typically give you an opportunity to get. The amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer. Fees for other. But if you're not pressed for money, it can be a better bet to wait to receive your refund from the IRS or explore other options. Just remember, when.

According to the IRS, most taxpayers receive their refunds in fewer than 21 days. If you can wait a few weeks, you will get your money without paying any. These types of loans are also known as income tax loans or early income tax loans. The interest rate and other terms are also dependent upon the lender. The. Waiting for a tax return can be hard though – especially when you need money There are no fees or interest for Tax Advance Loans when you file your taxes with. So it's no surprise that most would rather not wait too long to receive those funds. That's were tax refund advance loans come in. These loans allow tax. By filing taxes with H&R Block, receive a same-day tax advance up to $ Save with H&R Block's Refund Advance offering, with no interest & loan fees. An Easy Advance is a loan offered to taxpayers that file their taxes electronically with an ERO that uses Republic Bank for their Refund Transfers. Our clients could get up to $7, tax refund loan if TaxShield files their taxes. tax refund-related loan and not an actual tax refund or personal loan. When the Refund Advance loan program is active, you can apply for an Early Refund Advance loan by bringing in your latest pay stub(s) for all income sources and. If necessary, get a short-term loan but pay it back in full as soon as you get your refund. How Tax Refund Advances Work. Why offer free loans to tax prep. The public service ad campaign being launched this month will alert taxpayers to the high costs of these loans and will remind consumers that they can get their. Fast, safe and secure refund anticipation loan via direct deposit to a checking, savings, or prepaid account. Get your tax anticipated refund loans in here. Banks will ask for your income tax returns of ATLEAST past years before granting you loan. Moreover there should be at least 6 months gap. These RALs are less risky because tax filers are not required to repay the loan if the IRS finds that their actual refund differs from the amount the tax. If you need your refund check sooner rather than later or don't want to wait for the IRS to process your return, you may be able to get a tax refund advance. To get a tax refund loan, you need to file with a tax preparation service that offers them. You can often get your money in minutes after the IRS accepts your. With a tax refund advance loan, you can get the cash you need now while you wait for your tax refund. If you need to cover an immediate expense and know the. and investment professionals, and questions to ask. We also provide tools and calculators to help you make informed financial decisions—and we show you the. Getting your refund safely and quickly doesn't have to involve costly refund anticipation loans. Direct deposit lets you get all of your refund within days. So it's no surprise that most would rather not wait too long to receive those funds. That's were tax refund advance loans come in. These loans allow tax. Basically, the company is issuing a loan for the amount of your anticipated refund and your refund goes to them to pay off this loan. Not only will you pay the.

Free Checking With Overdraft Protection

Balance Connect for overdraft protection is an optional service which allows you to link your eligible checking account to up to 5 other Bank of America. Get overdraft protection. Choose the right level of overdraft protection coverage 3 for your free checking account. Easily move your money. Pay your bills. Your fee-free safety net. If you accidentally overspend, CoverDraft provides up to $ in temporary relief for common transactions. How it works. Limited automatic overdraft protection up to $ (or $ for Simply Free checking) applies to consumer checking accounts (excluding teen checking. No Overdraft fees · No monthly service fee · No minimum deposit to open or minimum balance requirement · No ATM fees from us (other banks and ATM operators'. The cost for overdraft fees varies by bank, but they may cost around $35 per transaction. These fees can add up quickly and can have ripple effects that are. 7 checking accounts with zero overdraft fees · 1. Capital One Checking® Account · 2. Ally Bank Spending Account · 3. Discover® Cashback Debit Account · 4. Axos. Free Blue™ includes a free debit card design that suits your style, access to Online Banking with BlueIQ™, and our Arvest Go mobile banking app, unlimited check. Overview. Truliant's Truly Free Checking2 is truly free. That means there is no minimum account balance and no maintenance fees. Balance Connect for overdraft protection is an optional service which allows you to link your eligible checking account to up to 5 other Bank of America. Get overdraft protection. Choose the right level of overdraft protection coverage 3 for your free checking account. Easily move your money. Pay your bills. Your fee-free safety net. If you accidentally overspend, CoverDraft provides up to $ in temporary relief for common transactions. How it works. Limited automatic overdraft protection up to $ (or $ for Simply Free checking) applies to consumer checking accounts (excluding teen checking. No Overdraft fees · No monthly service fee · No minimum deposit to open or minimum balance requirement · No ATM fees from us (other banks and ATM operators'. The cost for overdraft fees varies by bank, but they may cost around $35 per transaction. These fees can add up quickly and can have ripple effects that are. 7 checking accounts with zero overdraft fees · 1. Capital One Checking® Account · 2. Ally Bank Spending Account · 3. Discover® Cashback Debit Account · 4. Axos. Free Blue™ includes a free debit card design that suits your style, access to Online Banking with BlueIQ™, and our Arvest Go mobile banking app, unlimited check. Overview. Truliant's Truly Free Checking2 is truly free. That means there is no minimum account balance and no maintenance fees.

Plus, you won't pay a transfer fee when you have free checking benefits from Fifth Third Momentum Checking. We don't charge you to use your own money. Overdraft. Overdraft protection is a guarantee that a check, ATM, wire transfer, or debit-card transaction will clear if the account balance falls below zero. · There may. Automatically transfers funds from your NIHFCU savings to checking at no At the NIHFCU, you have access to many free, easy and convenient tools to. A checking account with no overdraft fees · With totally free access to Dollar Bank, Allpoint and Freedom ATM Alliance network ATMs, you can get cash at 55, With TD Bank Overdraft Protection and Services, no fees for overdrawing up to $50, Savings Overdraft Protection, more time with our Grace Period, and more. No overdraft fees. In most situations a transaction more than your balance won't go through. If it does, there's no fee. No surprise fees. Overdraft protection typically allows transactions exceeding the balance in your checking account to be approved and can save you steep overdraft fees. Optional Overdraft Protection Service (OOPS) · $20 fee for each overdraft per account · No fee on transactions of $5 or less, or if your total overdrawn balance. We make it easy for you to avoid overdraft fees with our Overdraft Protection Plan. Simply link a bank account to automatically cover the difference. More ways we can help you manage your money. · Online Banking · Bill Payer · Overdraft Protection · VISA® Debit Card. Overdraft Protection covers all transaction types – including, for example, ATM and debit card transactions, checks, Bill Pay, and recurring electronic. Opting in to Overdraft Coverage allows PNC to cover your ATM and everyday (one-time) debit card transactions when your available balance is not enough to cover. For additional overdraft protection Citizens offers two types of plan options on all of our personal checking accounts. For those who occasionally overdraw. Pay bills, cash checks, and send money with Chase Secure Banking SM, a checking account with no overdraft fees and no fees on most everyday transactions. Customers can select, after account opening, one of the other overdraft options (Free Savings Transfer or No-Fee Overdraft). Regardless of the option selected. Overdraft Protection. This is an optional service that you can enroll in, which lets you link your Chase savings account as a backup to your checking account. Enjoy early direct deposit, unlimited domestic ATM fee reimbursements, and no overdraft or monthly maintenance fees with Essential Checking from Axos Bank. New Checking accounts start in the Auto-Decline setting. Customers can select, after account opening, one of the other overdraft options (Free Savings. Sign up for Overdraft Protection and link your Wells Fargo credit card to your Wells Fargo personal checking accountFootnote 1. Then, if you happen to spend. For Consumer accounts: No charges will be assessed when the account is overdrawn twenty ($20) dollars or less at the end of the day. Overdraft charges are.